In the ever-evolving landscape of online transactions, ensuring the safety and security of our financial information remains a paramount concern. As we witness the surge in online shopping, catalyzed by the Covid-19 pandemic, it’s imperative to scrutinize the various payment methods available to us. From traditional credit cards to cutting-edge cryptocurrencies, each option carries its own set of pros and cons. Join us as we navigate through the intricacies of online payment methods, shedding light on the safest choices for your digital transactions.

Understanding the Landscape

Online shopping witnessed an unprecedented boom during the Covid-19 pandemic, with U.S. e-commerce sales skyrocketing to a staggering 469 billion USD in 2021, a significant leap from the previous year’s 431 billion USD. Amidst this surge, stalwarts like PayPal and credit/debit cards retained their dominance as the preferred modes of payment for online transactions. However, newer methods such as Apple Pay and cryptocurrencies like Bitcoin have also carved a niche for themselves in the digital payments ecosystem.

PayPal: The Epitome of Security

Pros:

- By utilizing PayPal, you minimize the risk of exposing your credit card information to multiple vendors, as you only need to share it with PayPal.

- The platform boasts robust cybersecurity measures, including end-to-end encryption, enhancing the security of your transactions.

- PayPal facilitates semi-anonymous payments, allowing users to register accounts using disposable email addresses and prepaid or virtual debit cards.

Cons:

- While transferring funds to friends and family is free, commercial transactions incur fees.

- Instances of data breaches at PayPal have been reported, highlighting potential security vulnerabilities.

Bottom Line: PayPal offers a secure payment method that mitigates the need to divulge your credit card details to every online vendor.

Credit Cards: A Shield Against Fraud

Pros:

- Credit card companies typically provide fraud protection, ensuring reimbursement and investigation of fraudulent transactions.

- Credit cards offer a universal acceptance and are backed by banking institutions, instilling confidence in online transactions.

- They provide a layer of separation between your funds and potential fraudulent activities.

Cons:

- Credit card transactions lack anonymity, and the risk of data breaches remains a concern.

- Compromised credit card details can lead to unauthorized transactions or identity theft.

Bottom Line: Credit cards stand out as a reliable option for online transactions, offering robust fraud protection and widespread acceptance.

Debit Cards: Balancing Control and Convenience

Pros:

- Debit cards limit spending to available funds, promoting financial discipline and control.

- In the event of theft, the perpetrator’s access is restricted to the available balance, minimizing potential losses.

Cons:

- Direct deduction from the checking account reduces recourse in case of disputes or fraudulent transactions.

- Some banks impose overdraft fees, adding to the cost of using debit cards.

Bottom Line: Debit cards offer a secure means of online payment, ideal for managing spending and providing controlled access to funds.

Prepaid Cards: Anonymity and Convenience

Pros:

- Prepaid cards facilitate anonymous transactions and can be purchased without divulging personal information.

- They offer a layer of security against identity theft and unauthorized transactions.

Cons:

- Upfront payment is required, and there is limited recourse for fraudulent transactions.

- Physical purchase of prepaid cards may be inconvenient for some users.

Bottom Line: Prepaid cards provide a convenient and anonymous method of online payment, albeit with certain limitations and considerations.

Digital Wallets: The Height of Convenience

Pros:

- Digital wallets enable seamless online, in-app, and in-person transactions.

- They offer enhanced security features, including biometric authentication and tokenized payment methods.

- Digital wallets eliminate the need to divulge credit card details to merchants, enhancing privacy and security.

Cons:

- Limited acceptance among online merchants remains a drawback for digital wallets.

- Users may encounter compatibility issues with certain platforms and websites.

Bottom Line: Digital wallets offer unparalleled convenience and security, revolutionizing the way we make payments in the digital age.

Mobile Payment Apps: Simplifying Peer-to-Peer Transactions

Pros:

- Mobile payment apps facilitate quick and easy transactions among friends and family.

- Some apps offer additional features such as balance maintenance, physical debit cards, and investment options.

Cons:

- Transaction fees may vary among different apps, impacting the overall cost of peer-to-peer transactions.

- Privacy concerns regarding social features and transaction visibility may deter some users.

Bottom Line: Mobile payment apps offer a convenient and efficient way to manage peer-to-peer transactions, catering to the evolving needs of consumers.

Cryptocurrencies: Navigating the Digital Frontier

Pros:

- Cryptocurrencies offer unparalleled privacy and anonymity, thanks to decentralized blockchain technology.

- Lower transaction fees and enhanced security features make cryptocurrencies an attractive option for online transactions.

Cons:

- Complexities and volatility in the cryptocurrency market pose challenges for novice users.

- Lack of centralized authority leaves users vulnerable to theft and fraudulent activities.

Bottom Line: Cryptocurrencies present a promising yet nuanced approach to online payments, ideal for users willing to navigate the complexities of the digital currency landscape.

FAQs

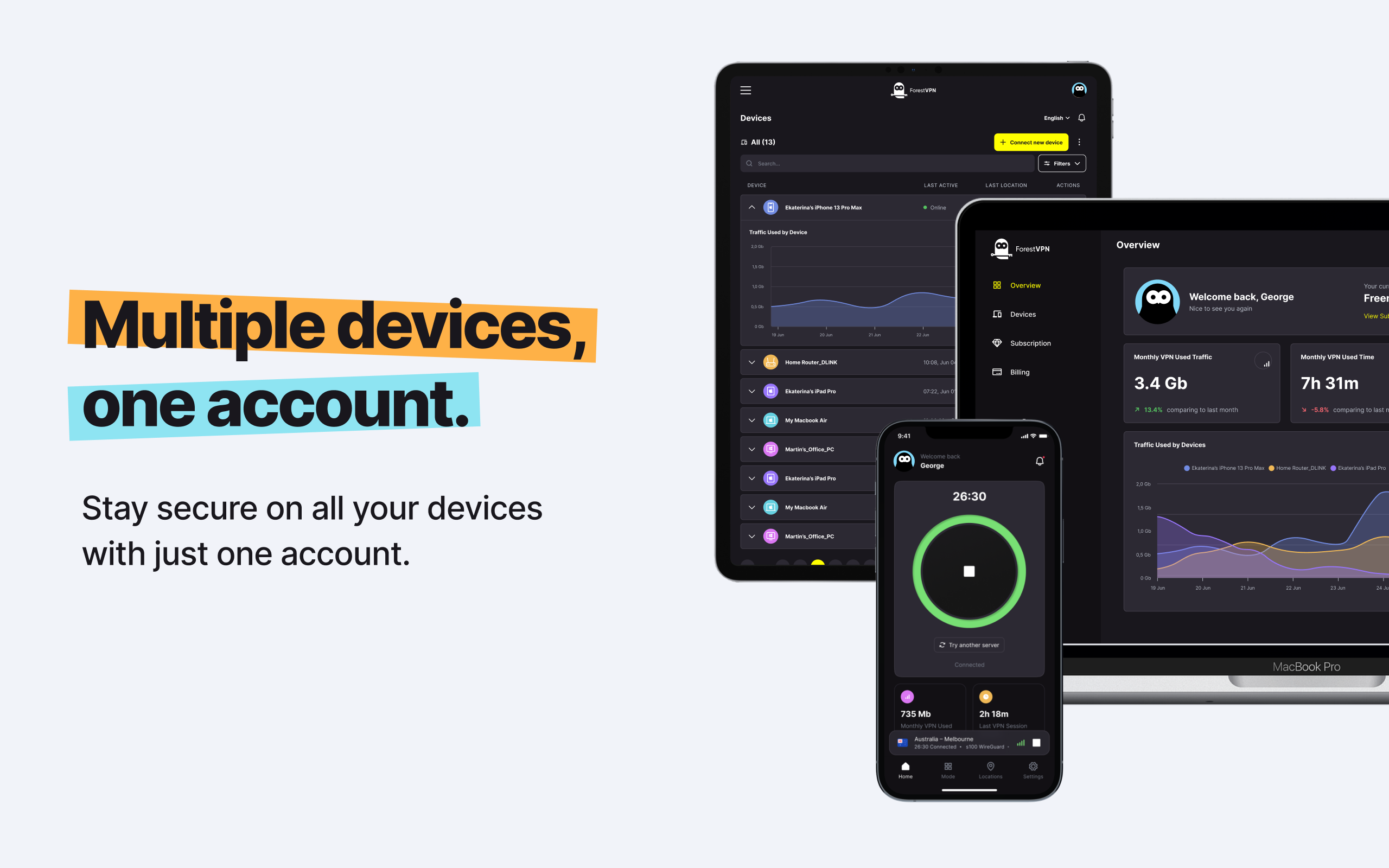

- Is ForestVPN compatible with all devices? ForestVPN is designed to be compatible with a wide range of devices, including smartphones, tablets, laptops, and desktop computers. Whether you’re using Windows, macOS, Android, or iOS, ForestVPN offers seamless integration and reliable performance across platforms.

- Does ForestVPN log user activity? ForestVPN adheres to a strict no-logs policy, ensuring that user activity remains private and confidential. We prioritize user privacy and security, refraining from logging any personal information or browsing history.

- How does ForestVPN ensure data security during online transactions? ForestVPN employs advanced encryption protocols and secure tunneling technologies to safeguard user data during online transactions. With ForestVPN, users can rest assured that their sensitive information remains protected from cyber threats and malicious actors.

Free Port Forwarding VPN

As we delve into the realm of online security, the quest for a robust VPN solution becomes imperative. ForestVPN emerges as a leading contender in the realm of free port forwarding VPN services, offering unparalleled security and reliability. Leveraging cutting-edge technology and a user-centric approach, ForestVPN ensures seamless port forwarding and enhanced privacy for your online activities.

In the pursuit of enhanced online security, ForestVPN stands as a beacon of reliability and innovation. Unlike other free VPN services, ForestVPN prioritizes user security and privacy, offering robust port forwarding capabilities without compromising on quality or reliability. With ForestVPN, users can enjoy seamless access to online content while safeguarding their personal information from prying eyes.