Crypto Landscape: A Gateway to Digital Assets

The cryptocurrency realm beckons enthusiasts with various avenues to acquire Bitcoin and other digital currencies. Embracing options such as Bitcoin ATMs, peer-to-peer transactions, or brokerage platforms, individuals seek the most accessible and secure means. Among these, cryptocurrency exchanges stand out as a popular choice, providing a diverse environment for trading, albeit with its own set of risks.

The Cryptocurrency Exchange Dilemma: Navigating Risk and Reward

Cryptocurrency exchanges, while pivotal for trading, are not immune to security challenges. In 2018 alone, approximately 1 billion USD vanished from these platforms due to hacking incidents. Thus, meticulous research becomes paramount to safeguard investments, ensuring a robust and secure trading experience. Factors such as security measures, coin variety, and trading features differentiate exchanges, influencing the overall user experience.

Top Crypto Exchanges: A Comparative Analysis

Amidst the plethora of cryptocurrency exchanges, choosing the right platform demands scrutiny. Each exchange possesses unique features, catering to diverse trading preferences. Let’s delve into the details of the top five cryptocurrency exchanges, providing insights into their strengths, weaknesses, and distinctive offerings.

1. Coinbase Pro: Maturity and Security in Focus

Coinbase, a stalwart in the crypto space since 2012, boasts a reputation for reliability and security. Operating in over 100 countries and accepting various fiat currencies, Coinbase Pro stands as an ideal choice for beginners. With a resilient security infrastructure, including cold wallet storage and two-factor authentication, Coinbase Pro prioritizes user safety. Additionally, insurance coverage for online funds adds an extra layer of protection.

2. Kraken: Approach to Crypto Trading

Founded in 2011, Kraken positions itself as a veteran exchange, accommodating both individual and business users. Supporting fiat payments in U.S. dollars, Canadian dollars, and euros, Kraken emphasizes simplicity in onboarding. Advanced features like margin trading and futures cater to users with diverse trading strategies. Security measures, including cold wallet storage and active bug bounty programs, underscore Kraken’s commitment to a secure trading environment.

3. Binance: The Meteoric Rise to Crypto Prominence

Binance, a relative newcomer since 2018, swiftly ascended to global prominence. Processing over 1.4 million transactions per second, Binance facilitates trading in a vast array of altcoins. The exchange, initially crypto-to-crypto focused, now supports credit card payments. Despite a notable hacking incident, Binance showcased transparency by compensating users from an emergency fund. With competitive trading fees and a discount for using Binance Coin (BNB), the platform remains a popular choice.

4. Gemini: Winkelvoss Twins’ Vision for Inclusive Finance

Conceived by the Winkelvoss twins, Gemini brings a unique perspective to cryptocurrency trading. Advocates for mainstream financial inclusion, Gemini underwent a rigorous security audit by Deloitte. The exchange, accepting U.S. dollars, focuses on Bitcoin, Bitcoin Cash, Ether, Litecoin, and Zcash. Adhering to crypto security norms, Gemini stores only a fraction of funds online, prioritizing the safety of user assets.

5. Huobi: From China to Global Crypto Hub

Originally founded in China, Huobi relocated to Singapore and expanded its global presence. Supporting a variety of cryptocurrencies and offering user-friendly options for both advanced traders and beginners, Huobi caters to a broad audience. With customer service available 24/7 and a substantial Bitcoin reserve fund for emergencies, Huobi positions itself as a reliable platform for cryptocurrency enthusiasts.

Crypto Landscape with Caution

Before embarking on your cryptocurrency trading journey, acquaint yourself with local tax regulations. In many jurisdictions, each crypto transaction constitutes a taxable event, necessitating diligent record-keeping. Additionally, be mindful of the regulatory landscape, as exchanges operating outside clear frameworks pose potential risks to your investments.

Conclusion

The world of cryptocurrency exchanges presents a dynamic landscape, offering diverse options for trading digital assets. As you explore the top exchanges, consider factors such as security, coin variety, and additional features that align with your trading preferences. Stay informed about tax obligations and regulatory nuances to ensure a seamless and compliant trading experience.

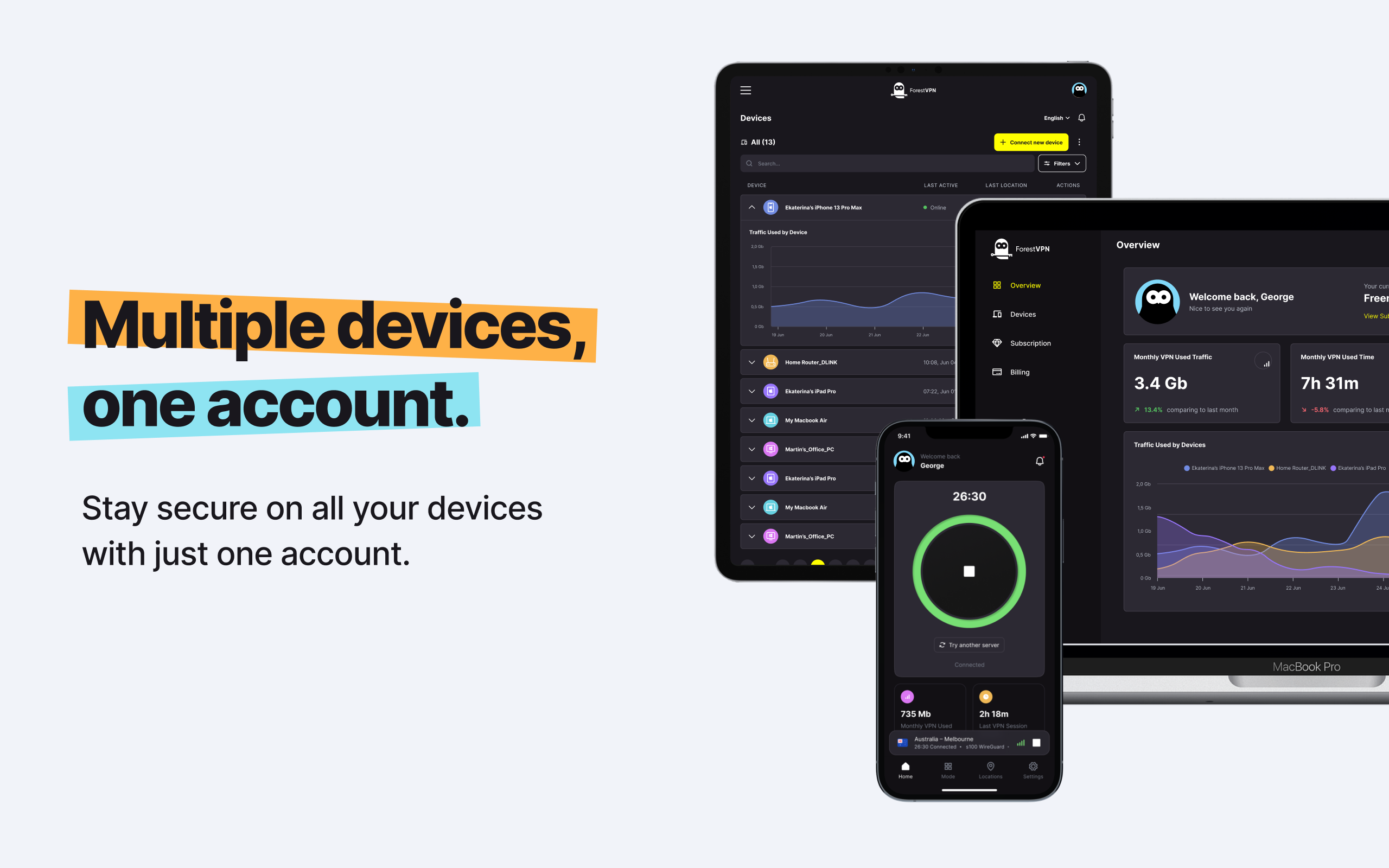

Free new zealand/Australia vpn

FAQ

Q:What should I consider when choosing a cryptocurrency exchange?

A:Consider factors such as security measures, coin variety, trading features, and the regulatory framework of the exchange.

Q:How can I ensure the security of my cryptocurrency investments?

A:Opt for exchanges with robust security measures, including cold wallet storage, two-factor authentication, and active bug bounty programs. Additionally, stay informed about the regulatory landscape.

Q:Are all cryptocurrency transactions taxable?

A:In many jurisdictions, each crypto transaction, even against another cryptocurrency, constitutes a taxable event. Familiarize yourself with local tax laws and maintain diligent record-keeping for compliance.